Japan CFTC JPY NC Net Positions fell from previous ¥125.4K to ¥121.8K

April 6, 2025 by admin

Filed under Forex Tips

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

United States CFTC S&P 500 NC Net Positions up to $-19K from previous $-53.4K

April 6, 2025 by admin

Filed under Forex Tips

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Dow Jones plummets as equities get pulverized by tariff tantrum

April 6, 2025 by admin

Filed under Forex Tips

- The Dow Jones got dragged into the depths on Friday, plummeting nearly 2,000 points.

- It’s the single worst day for equities since the pandemic selloff as the US kicks off a global trade war.

- China has announced its own retaliatory tariffs on the US, causing markets to brush off NFP.

The Dow Jones Industrial Average (DJIA) had one of its worst trading days since the pandemic period, shedding over 2,000 points to fall over 5% on the day and putting the major equity index on pace for one of its worst-ever trading days in absolute points terms. Global markets are roiling as the Trump administration gets its wish of a global trade war that pits the US against everybody else at the same time.

The Dow Jones fell to 38,500 on Friday, hitting its lowest levels in 10 months, and is down nearly 18% from record highs posted last November. The Standard & Poor’s 500 (S&P) megacap index is down over 300 points, falling over 5.5%. The Nasdaq Composite index also declined around 1,000 points, declining a matching 5.5% as equities across the board get pummeled by broad-market risk aversion.

Read more stock news: Nike stock spikes 5% after Vietnamese leader signals willingness to negotiate

China has announced its own retaliatory tariffs against the US’s “reciprocal” tariffs that were announced this week, which were ‘calculated’ by passing net imports and exports through a formula that has caught much derision across social media and economic circles. The Trump administration imposed a 34% tariff on China this week, sparking a retaliatory 34% tariff from China, sending global markets into a tailspin and kicking off another leg down in the tariff spiral.

US Nonfarm Payrolls (NFP) came in much stronger than expected, doing next to nothing to slow the pace of broad-market selling pressure. The US added 228K net new jobs in March, nearly double February’s revised print of 117K, which was sharply adjusted lower from 151K. US Average Hourly Earnings fell faster than expected to 3.8% YoY, dropping from the previous period’s 4.0%. The US Unemployment Rate also ticked higher to 4.2% versus the expected hold at 4.1%.

Despite the overall upside print in NFP net job gains, labor figures are beginning to show signs of weakness, cracks are beginning to appear in the US labor market. Coupled with impending economic weakness at the hands of the Trump team’s global tariffs, markets are pinning their bets on at least 100 bps in rate cuts from the Federal Reserve (Fed) by the end of the year. However, this bet is quickly coming to loggerheads with direct communication from Fed officials, who have significantly stepped up their calls for caution on policy changes in the face of the Trump administration’s aspirations of funding the US deficit entirely with trade taxes on US consumers.

Dow Jones price forecast

It’s a bad day to be an equity index. The Dow Jones has plummeted to ten-month lows, entirely erasing nearly a year’s worth gains and putting the major stock index well below the 40,000 major price handle. The Dow Jones is down 15% from the year’s peaks just above 45,000, and poised for further losses as the DJIA enters freefall well below the 200-day Exponential Moving Average (EMA) at 42,000.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Weighted Deviation Bands MT4 Indicator

April 6, 2025 by admin

Filed under Forex Tips

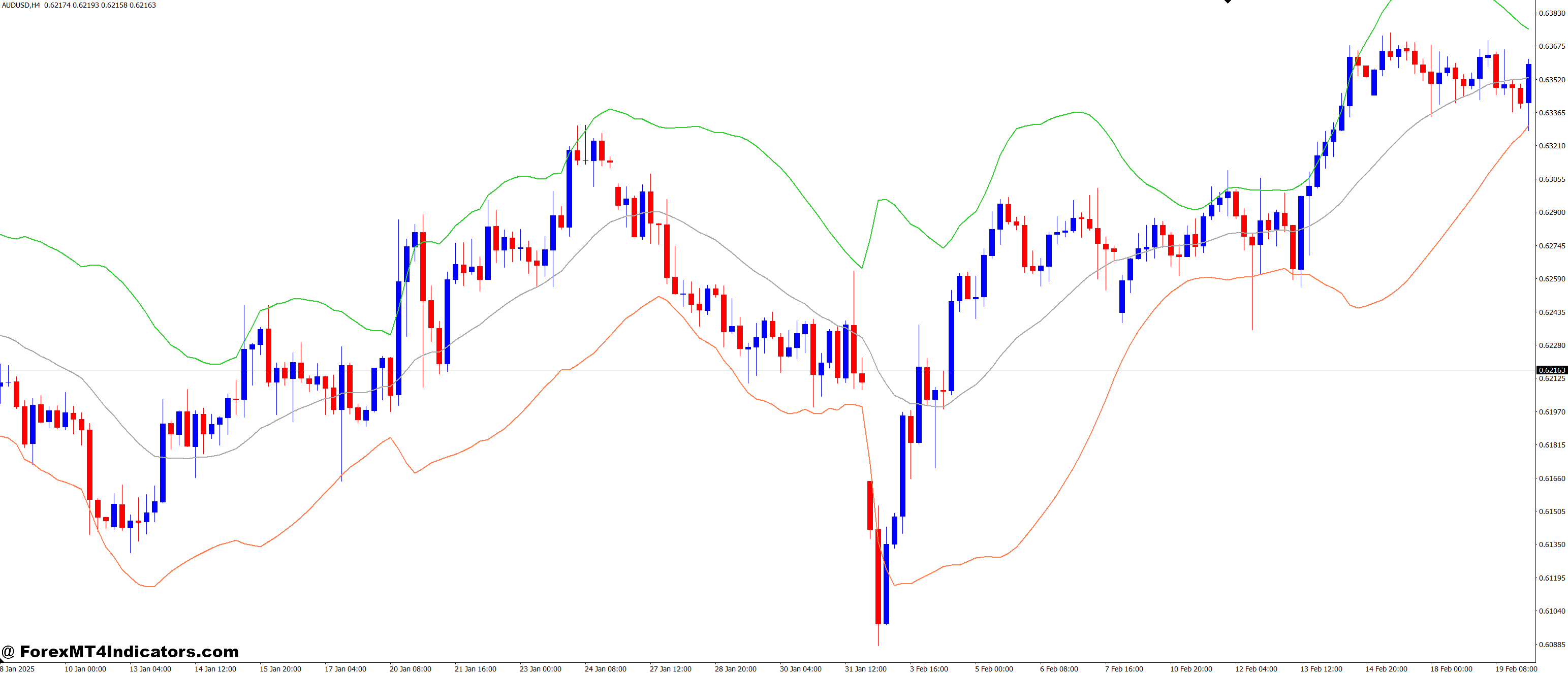

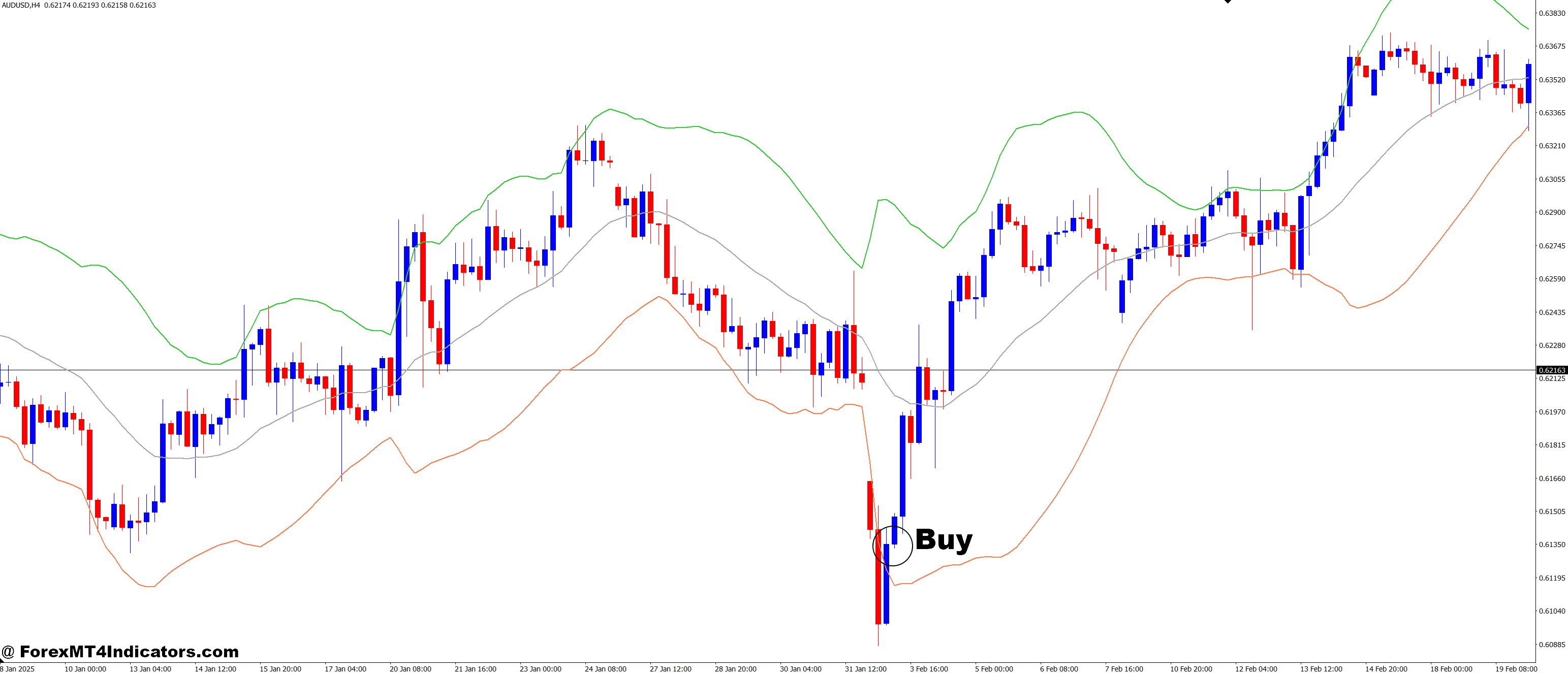

The Weighted Deviation Bands MT4 Indicator is an essential tool for traders looking to improve their market analysis and decision-making. Many traders struggle to identify trends and market reversals accurately, often leading to missed opportunities or unnecessary losses. This is where the Weighted Deviation Bands indicator steps in, offering a solution that helps traders spot market extremes and potential turning points more effectively. In this article, we’ll dive into how this indicator works, why it’s beneficial, and how it can make a difference in your trading strategy.

Understanding the Weighted Deviation Bands MT4 Indicator

The Weighted Deviation Bands MT4 Indicator is designed to offer a more dynamic approach to tracking price movements. It uses a weighted moving average to create upper and lower bands, adjusting based on market volatility. These bands provide traders with a clearer indication of potential support and resistance levels, making it easier to spot overbought or oversold conditions. By monitoring how the price deviates from the moving average, traders can gain insights into potential trend reversals or continuation patterns.

How It Enhances Trading Decisions

For traders, one of the biggest advantages of using the Weighted Deviation Bands MT4 Indicator is its ability to highlight price extremes. When the price moves outside the bands, it can signal that the market is overextended and might be due for a reversal. This visual representation makes it easier for traders to identify potential entry and exit points, reducing the guesswork involved in trading. By integrating this indicator into a trading strategy, traders can avoid chasing the market and focus on more calculated, high-probability trades.

The Indicator’s Versatility for All Traders

Whether you’re a beginner or an experienced trader, the Weighted Deviation Bands MT4 Indicator is a valuable addition to your toolkit. For novice traders, it simplifies complex market analysis, providing a clear, visual guide to potential market reversals. On the other hand, more experienced traders can use this tool in conjunction with other technical indicators to refine their strategies. Its adaptability makes it suitable for various trading styles and market conditions, offering a versatile solution for all levels of traders.

Optimizing Your Strategy with the Indicator

To maximize the effectiveness of the Weighted Deviation Bands MT4 Indicator, it’s important to combine it with other technical tools like the RSI or MACD for confirmation. By doing so, traders can ensure that they are not relying on a single indicator for trade decisions, reducing the chances of false signals. Adjusting the settings to match your preferred timeframes and risk tolerance can also help optimize its performance in different market conditions. Regularly testing and fine-tuning your strategy will lead to more consistent results.

How to Trade with Weighted Deviation Bands MT4 Indicator

Buy Entry

- Look for the price to be near or below the lower band of the Weighted Deviation Bands.

- Wait for the price to bounce back above the lower band, indicating a potential reversal to the upside.

- Confirm the buy signal with other indicators like the RSI (if it’s showing oversold conditions) or MACD (crossing above the signal line).

- Enter the trade when the price moves back above the lower band and shows signs of upward momentum.

- Set your stop-loss slightly below the lower band to manage risk.

Sell Entry

- Wait for the price to be near or above the upper band of the Weighted Deviation Bands.

- Observe for a price reversal or rejection from the upper band, indicating a potential downturn.

- Confirm the sell signal with other indicators like RSI (if overbought) or MACD (crossing below the signal line).

- Enter the trade when the price begins moving down from the upper band.

- Set your stop-loss slightly above the upper band to manage risk.

Conclusion

The Weighted Deviation Bands MT4 Indicator is a powerful tool that can significantly enhance a trader’s ability to spot market opportunities and improve decision-making. With its ability to highlight price extremes and potential reversals, this indicator simplifies complex market analysis and provides valuable insights. By integrating it into a comprehensive trading strategy, both beginner and experienced traders can improve their chances of making profitable trades.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

(Free MT4 Indicators Download)

December cycle prediction plays out as Nasdaq, S&P 500, Dow Jones bleed

April 6, 2025 by admin

Filed under Forex Tips

Nasdaq plunges 20%, S&P 500 and Dow Jones tumble as Trump’s tariffs spark full-scale correction—historical patterns signal deeper losses ahead

The writing was on the wall, as clearly outlined in our December 2024 analysis titled “Is the US stock market bull run running out of steam? Historical patterns signal possible endgame.” At that point, our analysis warned investors that major US indices—the Nasdaq 100, S&P 500, and Dow Jones—were nearing critical inflection points after a relentless bull market run. The Nasdaq 100 peaked around 22010, the S&P 500 at 6020, and the Dow Jones at approximately 45050.

Fast-forward to April 2025, and the predictions are manifesting before our eyes. Structural weaknesses first observed in February 2025 have now deepened into a major market downturn, exacerbated by geopolitical turmoil from the “Trump Liberation Day” tariffs. These tariffs have not only unsettled global trade but also acted as the final catalyst triggering panic-selling across equity markets.

December 2024 analysis headline

Nasdaq 100 enters bear market territory

The Nasdaq 100, typically sensitive to shifts in risk sentiment, has now fallen dramatically into a textbook bear market, declining 20% from its all-time high. At the time of writing, the index trades near the critical support at 17285, marking the second stage of the anticipated major pullback. The selling intensified sharply in the past two trading sessions, shedding more than 5% amid intensifying fears of prolonged trade tensions.

Technical analysis indicates that if Nasdaq loses the immediate support level at 17444, it opens the door for further declines toward 16836. Any short-term recovery attempts face significant resistance around 18205 and then again at the critical pivot near 18440.

Nasdaq 100 December 2024 analysis

Nasdaq 100 April 4th 2025 analysis

S&P 500 deepens correction, critical levels approaching

The S&P 500 (SPX) has mirrored the Nasdaq’s weakness, suffering severe losses and declining over 16% from its record highs. In the last two days alone, SPX dropped 6%, underscoring market panic. Currently, the index is testing a significant technical zone at 5151—the second stage of its corrective cycle identified in December’s analysis.

If selling pressure persists below 5151, investors could see accelerated declines toward subsequent support levels at 5030 and 4955. A potential third stage of this major market correction would likely drive prices even lower, targeting the crucial support level at 4834. Any upside recovery would encounter significant resistance at 5225 and 5300, limiting the chances of a sustained rebound in the near term.

US 500 December 2024 analysis

US 500 April 4th 2025 analysis

Dow Jones faces China’s retaliation

The Dow Jones Industrial Average (DJIA), previously considered a haven for stability, is also bleeding heavily. The DJIA has dropped by approximately 1450 points over two sessions, marking a decline of over 14% from its historical highs. China’s swift retaliatory tariffs against Trump’s policies further intensified selling pressure, driving the Dow Jones sharply lower.

Currently trading at the critical second-stage support of 38982, further downside looks increasingly likely. Should the index fail to hold this level, subsequent support levels are found at 38508 and, notably, 37743. A deeper third-stage correction scenario outlined in our December analysis targets the critical psychological and technical support at 36504. Any bullish reversal attempt faces substantial resistance at 39747 and, more significantly, at 40230.

Dow Jones December 2024 analysis

Dow Jones April 4th 2025 analysis

Fundamental catalysts fueling the sell-off

The recent sell-off has not only been a technical phenomenon but also reflects significant fundamental shifts:

- Trump Liberation Day Tariffs: These protectionist policies, initially targeting Canada and Mexico, have expanded into a broader trade war with China, severely disrupting global trade dynamics and investor confidence.

- Deteriorating Economic Outlook: Rising geopolitical tensions combined with higher inflation and interest rate pressures from the Federal Reserve have further deteriorated sentiment.

- Corporate Earnings Concerns: With tariffs affecting supply chains and profitability, investors now anticipate weaker corporate earnings guidance, adding fuel to market declines.

Historical patterns offer clues for what’s next

Historical patterns, as extensively detailed in our December 2024 analysis, suggest that the selling typically accelerates once markets enter this correction phase before reaching a sustainable bottom. Investors should brace for heightened volatility and more downside risks until clearer signs of stabilization emerge, potentially over the coming months or even a year.

Conclusion and investor takeaways

The ongoing market turmoil is a timely reminder of the predictive power of historical cycles and comprehensive technical analysis. Investors should exercise caution and remain vigilant of critical levels highlighted in this analysis. While short-term rebounds may occur, the broader trend clearly points toward sustained bearish pressure.

As markets navigate these turbulent waters, prudently managed portfolios, careful risk management, and close monitoring of technical and fundamental indicators will be crucial. I will continue to provide timely updates to guide investors through these unprecedented market developments.

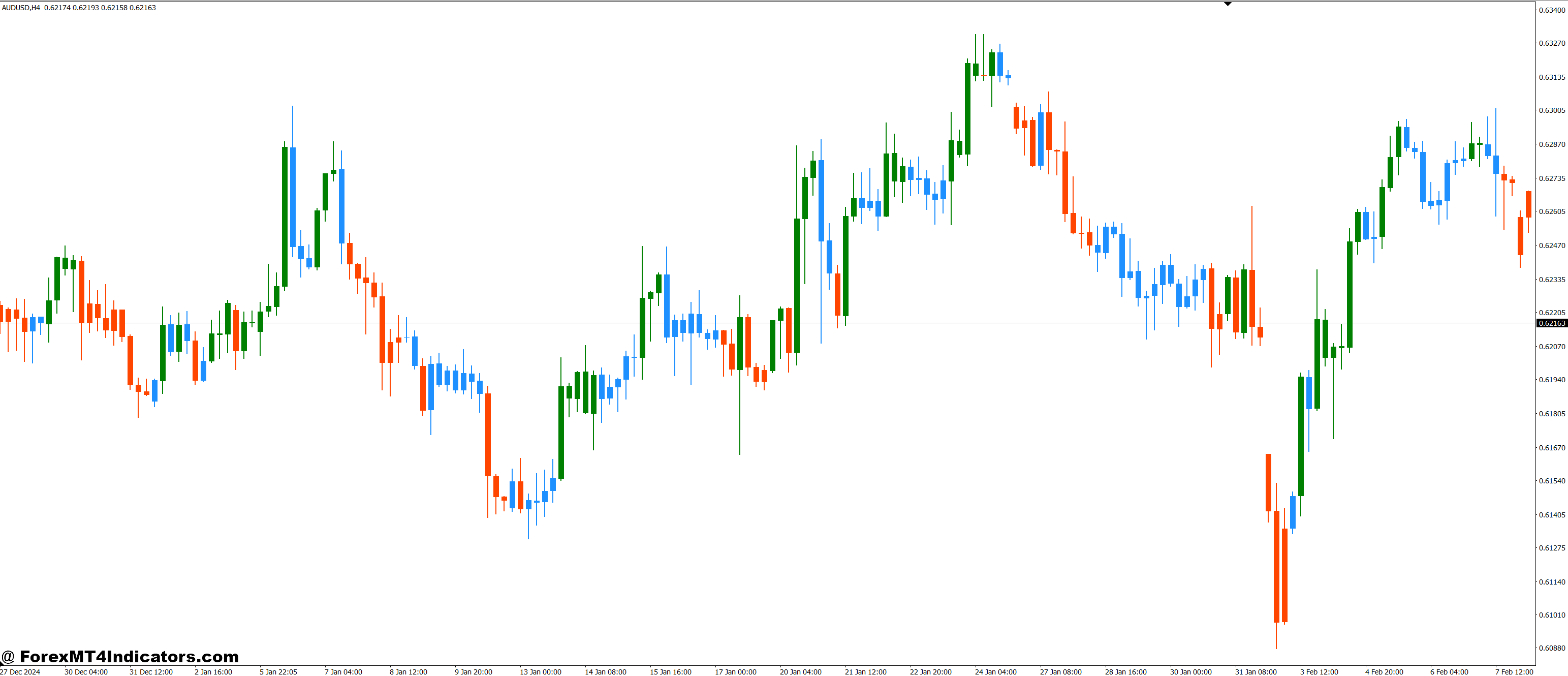

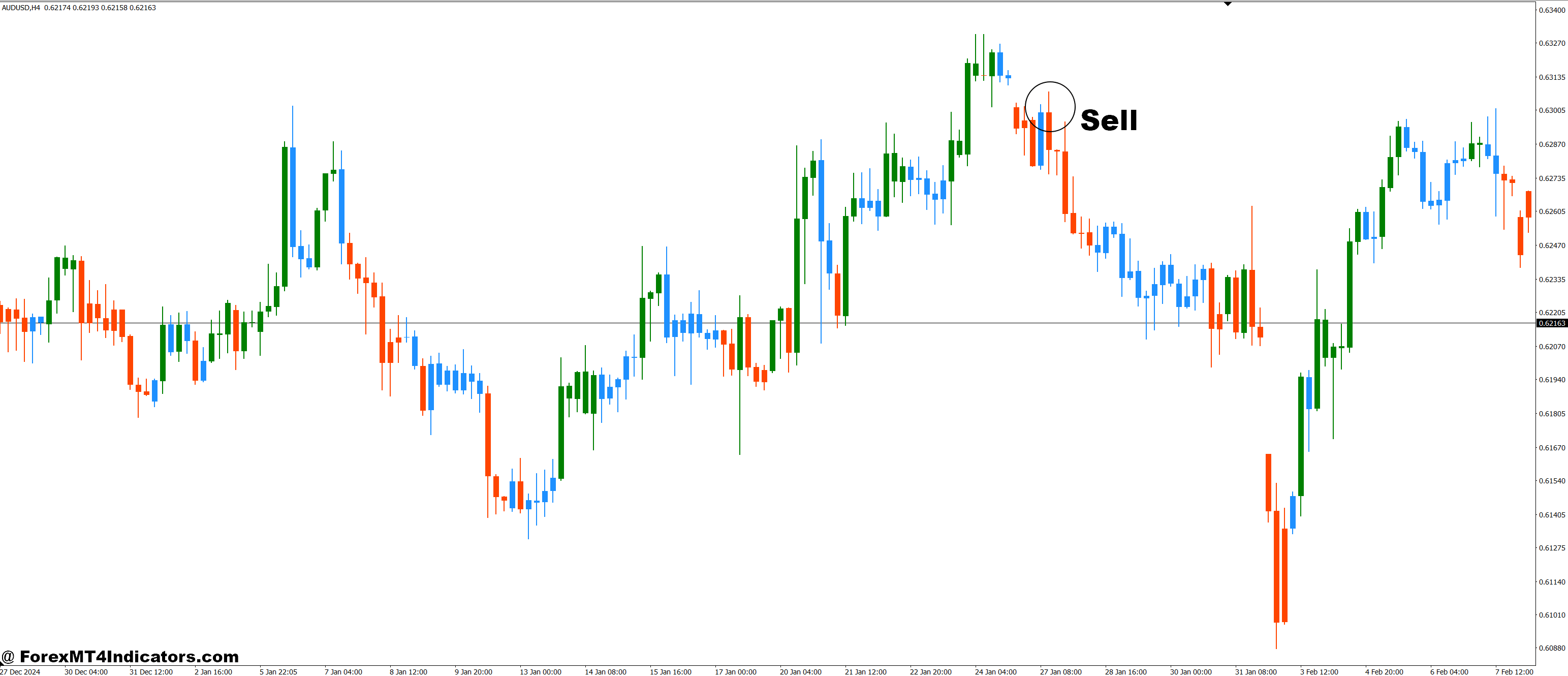

Elder Impulse System Candlestick MT4 Indicator

April 5, 2025 by admin

Filed under Forex Tips

The Elder Impulse System Candlestick MT4 Indicator is a powerful tool for traders looking to improve their decision-making in volatile markets. One of the most challenging aspects of trading is knowing when to enter or exit a trade, especially when the market is unpredictable. This can lead to missed opportunities or unnecessary losses. The Elder Impulse System offers a solution by providing clear visual signals based on candlestick patterns and momentum. In this article, we’ll dive into how this indicator works and why it’s a valuable addition to any trader’s strategy.

What is the Elder Impulse System Candlestick MT4 Indicator?

The Elder Impulse System Candlestick MT4 Indicator was created by Dr. Alexander Elder, a well-known trading expert. It combines the power of candlestick patterns with momentum indicators to help traders identify when market conditions are shifting. The system uses a color-coded approach to indicate whether the market is trending upwards, downwards, or moving sideways. By simplifying the process of identifying trends, this indicator helps traders make more informed decisions, potentially improving their chances of success in the market.

How the Indicator Works

The Elder Impulse System Candlestick MT4 Indicator relies on three key components: price bars, moving averages, and momentum oscillators. These elements work together to generate clear signals that guide traders in making decisions. The indicator changes color based on market conditions: green for an uptrend, red for a downtrend, and yellow for a neutral market. This visual approach makes it easier to spot potential entry or exit points, especially when paired with candlestick patterns. Traders can use these signals to stay in sync with the market, reducing the risk of making poor trades.

Why Traders Use This Indicator

One of the main reasons traders love the Elder Impulse System Candlestick MT4 Indicator is its simplicity and accuracy. Unlike many indicators that can give conflicting signals, this system integrates multiple sources of market data into one easy-to-understand signal. It helps traders stay on the right side of the trend without overcomplicating their analysis. Additionally, the indicator works well across different time frames, making it versatile for both short-term and long-term trading strategies. Whether you’re day trading or investing for the long haul, this tool can support your trading decisions.

How to Trade with Elder Impulse System Candlestick MT4 Indicator

Buy Entry

- Green Signal: The indicator changes to a green color, indicating an uptrend.

- Confirm Candlestick Pattern: Look for a bullish candlestick pattern (such as a bullish engulfing or hammer) to confirm upward momentum.

- Momentum Confirmation: Ensure that the momentum oscillator aligns with the trend, showing bullish momentum.

- Above Moving Average: Ensure that the price is above the moving average, suggesting the trend is up.

- Volume Increase: Ideally, there should be an increase in trading volume, confirming the strength of the trend.

Sell Entry

- Red Signal: The indicator turns red, signaling a downtrend.

- Confirm Candlestick Pattern: Look for a bearish candlestick pattern (such as a bearish engulfing or shooting star) to confirm downward momentum.

- Momentum Confirmation: Ensure the momentum oscillator aligns with the trend, showing bearish momentum.

- Below Moving Average: The price should be below the moving average, indicating the market is in a downtrend.

- Volume Increase: A rise in trading volume strengthens the confirmation of the bearish trend.

Conclusion

The Elder Impulse System Candlestick MT4 Indicator is a reliable tool that helps traders navigate the complexities of the financial markets. By combining candlestick patterns with momentum signals, it provides clear, actionable insights that can improve trading performance. Whether you’re just starting or you’ve been trading for years, this indicator can enhance your ability to spot trends and make informed decisions. If you’re looking to take your trading to the next level, the Elder Impulse System might be just the tool you need.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

(Free MT4 Indicators Download)

Newsquawk Week Ahead: US & China CPI, FOMC Minutes, RBNZ, US Earnings Season, UK GDP

April 5, 2025 by admin

Filed under Forex Tips

- Mon: Japanese Cash Earnings (Feb), German Trade Balance (Feb), EZ Retail Sales (Feb), EZ Sentix Index (Apr)

- Tue: N/A

- Wed: FOMC Minutes, RBNZ Announcement, RBI Announcement

- Thu: Chinese Inflation (Mar), Swedish GDP (Feb), Norwegian CPI (Mar), Taiwan Trade Balance (Mar), US CPI (Mar)

- Fri: UK GDP (Feb), US PPI (Mar), US UoM Prelim (Apr), US Earnings Season (Q1 25)

Japanese Cash Earnings (Mon):

There are currently no expectations for the Japanese Cash Earnings metrics, although the data will be watched by the BoJ for the wage trend. As a reminder, last month’s release saw Japan’s real wages fall 1.8% year-on-year in January, as rising inflation—at a two-year high of 4.7%—outpaced solid nominal wage growth. While regular and overtime pay saw their strongest gains in decades, a drop in bonuses dragged overall nominal earnings lower. Japan’s largest Labour union group, Rengo, secured an average 5.46% pay hike in this year’s spring wage negotiations — the biggest since 1991. Base pay rose 3.84%, and even smaller firms saw stronger gains, signalling broad wage momentum. In the latest BoJ rate decision, the central bank provided no surprises at this week’s meeting as it maintained rates at 0.50% which was widely expected, given that the central bank just hiked at the last meeting in January, while the decision on rates was made unanimously. The central bank refrained from providing any major clues on policy in which it noted that Japan’s economy is recovering moderately, albeit with some weak signs, and that consumption is increasing moderately as a trend and inflation expectations are also heightening moderately.

FOMC Minutes (Wed):

At its March meeting, the Fed kept rates unchanged, as expected, and maintained its forecast of two rate reductions in 2025. It removed language from its statement suggesting risks to its goals were balanced, citing increased uncertainty. However, it reiterated that “economic activity has continued to expand at a solid pace,” labour market conditions “remain solid,”, and inflation “remains somewhat elevated.” However, it did add that “uncertainty around the economic outlook has increased.” Its 2025 and 2026 growth projections were lowered, with higher unemployment, and it lifted its PCE inflation forecasts. It also announced that starting April, the pace of balance sheet runoff will slow, reducing the monthly Treasury redemption cap to USD 5bln (from the current USD 25bln), though the MBS cap remains unchanged at USD 35bln. Analysts were not very surprised by the announcement, given the use of its reverse repo facility has declined significantly this year. The prior meeting minutes also alluded to a slowdown of the balance sheet runoff, although the March meeting was not explicitly signalled by policymakers. The projections also showed that FOMC members are divided on the number of cuts in 2025; the dot plot continues to show two rate cuts this year, and projections for 2026 and the long-term forecast were left unchanged, but four participants now expect rates to be unchanged in 2025 (vs just one previously), and four members expect only one rate cut. In his press conference, Chair Powell stressed a wait-and-see approach, emphasising uncertainty ahead. He noted rising short-term inflation expectations but highlighted that long-term expectations remain stable. Powell acknowledged tariffs contribute to higher goods prices but are hard to quantify in terms of inflation. He said the Fed could either cut or hold rates at a “clearly restrictive” level. On the balance sheet, he clarified that the slowdown in runoff was a technical adjustment, not a policy shift. He also clarified that removing the language about balanced risks was not a signal. Since the meeting, markets have been rocked by the US tariff announcements this week, which analysts said have the potential to lower the US growth trajectory while boosting inflation. Reports note that the tariffs imposed by President Trump create a challenging environment for the Fed, complicating efforts to control inflation and prevent a recession. Bloomberg said it might lead to a cautious approach by the central bank as it monitors the economic impact before taking further action. Still, money markets began to discount four 25bps rate reductions this year following the announcement. Morgan Stanley, however, has leaned back on this, with the bank scrapping its call for a June Fed cut after Trump’s tariff announcement, as a result of “tariff-induced inflation,” and now sees the FOMC on hold until next March. MS said that if tariffs persist, US economic growth may suffer, with downside risks increasing.

RBNZ Announcement (Wed):

The RBNZ is expected to cut rates for the fifth straight meeting with a Reuters poll showing all 31 economists surveyed expect the Official Cash Rate to be lowered by 25bps to 3.50%. Money markets are pricing in a 97% chance for such a move and just a 3% probability for a greater 50bps cut to 3.25%. The meeting will be the first in the post-Orr era after former Governor Orr suddenly resigned in March, three years before his term was set to end, while Deputy Governor Hawkesby was appointed as Acting Governor until a new Governor is appointed which is said to likely to be a six to nine-month process. As a reminder, the RBNZ delivered a third consecutive jumbo 50bps rate cut and its fourth straight rate reduction at the last meeting in February, which was widely expected, while the central bank noted rates were reduced further as inflation abated and if economic conditions continued to evolve, there was scope to lower the OCR further in 2025. The RBNZ also stated that the committee has the confidence to continue lowering rates and economic activity remains subdued but noted that a recovery is expected over this year. Furthermore, the central bank cut its rate projections with the June 2025 forecast lowered to 3.45% from 3.83% and the March 2026 forecast was cut to 3.10% from 3.43%. The then Governor stated during the press conference that the OCR path projects 50bps of cuts by mid-year around July, in two 25bps steps, with cuts in April and May about right. Orr also commented the following day that he was feeling more positive about the inflation situation and expects the OCR will be around 3.00% by year-end, as well as noting there would have to be an economic shock to cut by 50bps again. Despite Orr’s departure, the remaining six members of the MPC are unlikely to deviate from the signalled rate path with rhetoric from officials very light since the last meeting, while recent GDP data also showed New Zealand’s economy exited a recession in Q4 which suggests the lack of urgency for another oversized rate cut.

RBI Announcement (Wed):

RBI is forecast to continue cutting rates with the Repurchase Rate expected to be cut by 25bps to 6.00% after delivering a similar magnitude cut at the last meeting. However, money markets are pricing around an 82% chance of a greater 50bps cut and an 18% likelihood of a 25bps cut. As a reminder, the central bank unanimously decided to cut rates for the first time in almost five years at the February meeting which was the first policy decision under Governor Malhotra who took over the stewardship at the central bank in December, while the MPC was also unanimous in its decision to maintain a neutral policy stance. The RBI Governor noted at the policy address that average inflation has been lower since the introduction of the framework and that CPI has mostly stayed aligned with the target, barring a few occasions, as well as noted the global economic backdrop remains challenging. Furthermore, the central bank lowered its FY25 Real GDP growth forecast to 6.4% vs 6.6% previously but maintained its FY25 CPI inflation view at 4.8%. The data since then has shown a continued softening of CPI Inflation which slowed to 3.61% vs. Exp. 3.98% (Prev. 4.31%) to print below the central bank’s 4% target and effectively increased the scope for a further rate cut, while GDP for the December quarter accelerated but printed just short of estimates at 6.2% vs. Exp. 6.3% (Prev. 5.4%). Furthermore, recent global trade uncertainty with Trump tariffs and the newly announced US reciprocal tariff of 26% for India also supports the case for the central bank to continue to ease policy, while the appointment of former World Bank economist Poonam Gupta to replace former Deputy Governor Patra is seen by Bloomberg as strengthening the case for the RBI to step up its easing efforts with a potential 50bps cut.

Chinese Inflation (Thu):

There are currently no forecasts for the Chinese inflation data. Typically, the data will be closely watched by markets for a prognosis of the world’s second-largest economy, particularly with sluggish domestic demand continuing to be a grey cloud. That being said, this set of data will likely be stale given US President Trump’s recent “Liberation Day” tariff announcement which resulted in 54% in cumulative tariffs from 20%. China’s Commerce Ministry said China firmly opposes US reciprocal tariffs and will resolutely take countermeasures to safeguard its rights and interests, while it urged the US to immediately cancel unilateral tariff measures and properly resolve differences with trading partners through equal dialogue. Goldman Sachs believes the latest US tariffs would further drag China’s GDP growth by around 1 percentage point, taking the total drag to 1.7 percentage points.

US CPI (Thu):

Analysts expect headline US CPI to rise 0.2% M/M in March, matching the February reading; the core rate of inflation is seen climbing by 0.3% M/M, picking up from the prior pace of 0.2%. However, the market may not be as sensitive to the data as it has been in recent months, given the US announcement of tariffs on trading partners has the potential to boost prices ahead, analysts have said. “The March CPI data will feel dated following President Trump’s announcement of significantly larger tariffs across trading partners, but should shed some light on how the changing trade environment was already beginning to affect pricing,” Wells Fargo writes, and while it thinks that March could mark the nadir in core inflation this year, the administration’s efforts to reorient US trade could lead to faster price growth.

Norwegian CPI (Thu):

There is currently no newswire consensus for Norway’s inflation report, but these metrics will be key in determining the future rate path at the Norges Bank. To recap the last meeting, there were some outside expectations for the Bank to deliver a (previously guided) 25bps cut, but members opted for a hold given the recent pickup in inflation. Norges Bank highlighted the uncertainty of the inflation outlook and said that “if the policy rate is lowered prematurely, prices may continue to rise rapidly”. The accompanying rate path indicates two cuts in the latter end of 2025 (albeit skewed to just one) vs the prior rate path which points towards three cuts. So whilst this report may have little sway in the immediacy, it could filter into the debate between one or two cuts this year – particularly as members look to future inflation reports to reduce current uncertainty.

UK GDP (Fri):

Expectations are for M/M GDP in February to pick up to +0.1% from -0.1% with the 3M/3M rate seen at 0.4% vs. prev. 0.2%. As a reminder, the prior release saw a 0.1% M/M contraction in January vs. the 0.4% expansion seen in the prior month. Capital Economics attributed the downside to payback from a surprisingly strong December i.e. December data “made the economy look stronger than it really was”. This time around, analysts at Investec, who forecast an above-consensus print at 0.2%, suggest that the upside in the headline could be driven by the strong outturn for retail sales in February. That being said, the desk doubts that “other parts of the services output performed quite as well”. Elsewhere, Investec expects a strong showing for manufacturing as “companies may have boosted output temporarily in order to ship what they could into the US ahead of higher US tariffs taking effect”. Nonetheless, this would only represent a partial bounce back from the pronounced drop in January and will likely be followed by “negative payback in the coming months”. For the quarter as a whole, Investec looks for a Q1 growth rate of 0.4% vs. the MPC forecast of 0.25%. From a policy perspective, the release will likely have little impact on BoE pricing given the recent imposition of global tariffs by the Trump administration and the MPC’s focus on its inflation mandate. As it stands, the next 25bps rate cut is fully priced by June with a total of 75bps of loosening seen by year-end.

US Earnings Season (Fri):

With Q1 25 earnings kicking off next week with the banking sector on Friday, FactSet highlights that the expected annual earnings growth rate for the S&P 500 is 7.3% Y/Y. “If 7.3% is the actual growth rate for the quarter, it will mark the seventh-straight quarter of (year-over-year) earnings growth reported by the index.” FactSet also highlights that all 11 sectors are expected to report lower earnings when compared to the end of 2024, due to downward revisions to EPS estimates. On guidance, FS writes “68 S&P 500 companies have issued negative EPS guidance and 39 S&P 500 companies have issued positive EPS guidance”. Of course, guidance will be key given the economic uncertainty ahead, following US President Trump’s aggressive tariffs on the globe which has seen equity markets tumble.

This article originally appeared on Newsquawk.

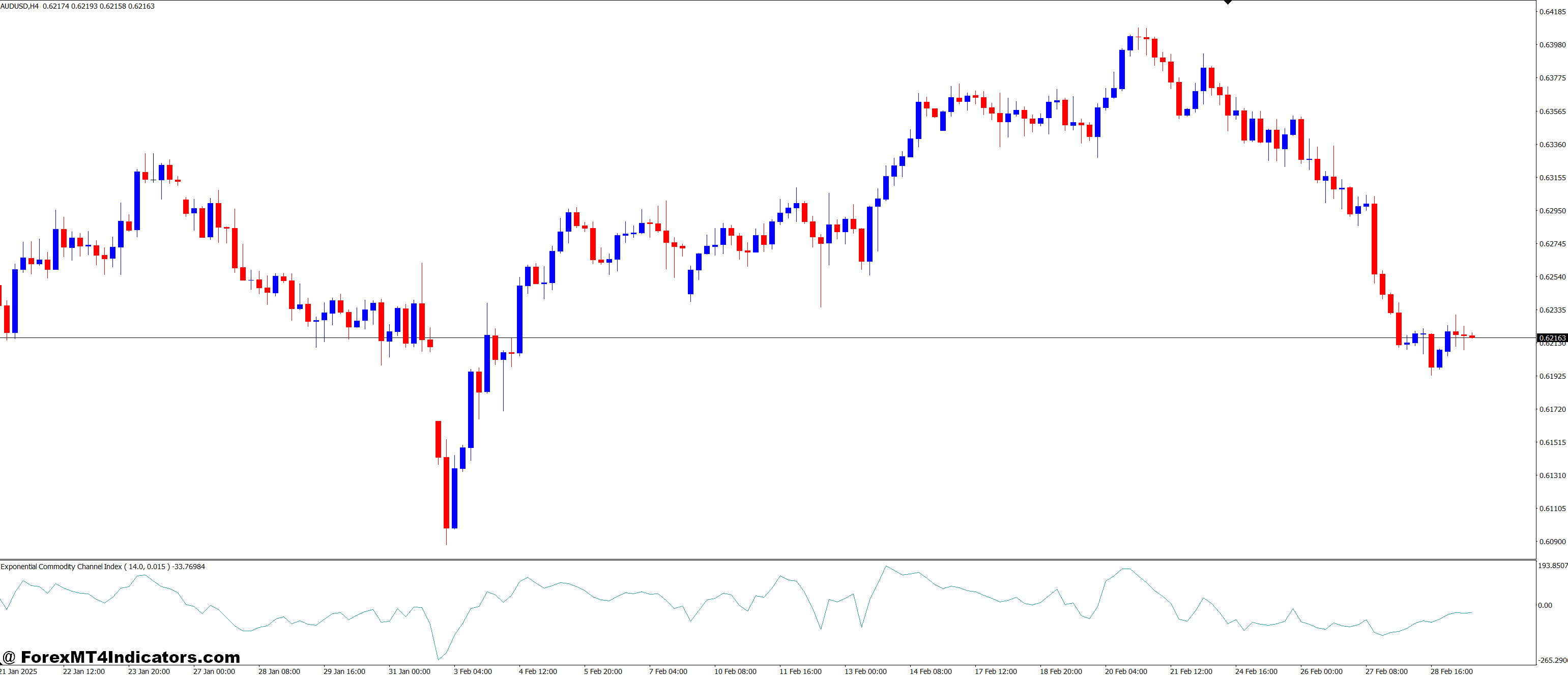

Exponential Commodity Channel Index MT4 Indicator

April 5, 2025 by admin

Filed under Forex Tips

The Exponential Commodity Channel Index (XCCI) for MetaTrader 4 (MT4) is an advanced technical tool that enhances the effectiveness of traditional trading strategies. Traders often struggle with identifying reliable buy or sell signals, especially in fast-moving or volatile markets. While the traditional Commodity Channel Index (CCI) is a valuable indicator, it can sometimes lag, leading to missed opportunities. The Exponential Commodity Channel Index solves this issue by offering more sensitivity and faster responses, helping traders to act quickly and confidently. In this article, we’ll explore the features, benefits, and practical uses of the XCCI on the MT4 platform, showing you why it’s a valuable tool for your trading arsenal.

What is the Exponential Commodity Channel Index (XCCI)?

The Exponential Commodity Channel Index (XCCI) is an improved version of the classic CCI, designed to provide quicker and more accurate signals. Unlike the standard CCI, which uses a simple moving average, the XCCI applies an exponential moving average (EMA) to the index. This adjustment makes the XCCI more sensitive to recent price movements, allowing traders to detect trends and reversals sooner.

The traditional CCI, while useful, sometimes fails to catch fast market shifts, leading to delayed reactions and missed trades. The Exponential Commodity Channel Index solves this problem by emphasizing more recent data, making it a superior tool for trading in dynamic market conditions. With this enhanced responsiveness, traders can more easily identify potential price changes, ensuring they are always one step ahead.

How the XCCI Improves Market Timing

One of the biggest challenges in trading is timing—knowing when to enter or exit a market can make all the difference. Traditional indicators like the CCI can lag, leaving traders with fewer opportunities to capitalize on quick market changes. The Exponential Commodity Channel Index overcomes this issue by smoothing price data in a way that provides more timely insights.

For example, when the price moves rapidly, the XCCI reacts faster than the regular CCI, offering earlier signals of an overbought or oversold condition. This allows traders to act before the market fully adjusts, giving them an edge in catching trends early. Whether you’re trading stocks, forex, or commodities, the XCCI can help you make better decisions based on the most recent market information.

Using the Exponential Commodity Channel Index with MT4

Installing and using the Exponential Commodity Channel Index (XCCI) on the MetaTrader 4 (MT4) platform is straightforward. After downloading the XCCI indicator from a trusted source, it can be easily added to any chart in your MT4 terminal. Once installed, the XCCI will appear as a line oscillating around a central zero line, similar to the traditional CCI.

You can adjust the settings to customize the indicator to your trading style. For example, you can change the period of the exponential moving average (EMA) or adjust the threshold levels to suit your strategy. Many traders prefer to use the XCCI in conjunction with other indicators, such as moving averages or RSI, to confirm signals and strengthen their trading decisions. Combining the XCCI with other technical analysis tools allows traders to create more reliable and robust strategies.

Benefits of Using the Exponential Commodity Channel Index

The Exponential Commodity Channel Index offers several key benefits that can significantly enhance a trader’s ability to make profitable decisions:

- Increased Sensitivity: The XCCI reacts more quickly to price changes using an exponential moving average, allowing traders to catch trends earlier.

- Better Timing: The XCCI helps improve market timing by providing earlier signals of overbought or oversold conditions, crucial for entering or exiting trades at the right moments.

- Versatility: The XCCI can be combined with various other indicators, such as trend-following or oscillating indicators, to give traders a more comprehensive view of market conditions.

- User-Friendly: MT4 makes it easy to install and customize the XCCI, making it accessible to both beginners and experienced traders alike.

How to Trade with Exponential Commodity Channel Index MT4 Indicator

Buy Entry

- XCCI crosses above the +100 level: This indicates a strong bullish trend and potential buying opportunity.

- XCCI moves from negative to positive territory: When the XCCI shifts from below 0 to above 0, it suggests increasing bullish momentum.

- XCCI is above the zero line and trending upwards: A rising XCCI in the positive range signals strength in the current uptrend.

- Support level confirmation: Look for price bouncing off a support level while the XCCI shows upward movement, signaling a potential buy.

- Divergence: If the price makes a new low while the XCCI shows a higher low, it indicates a potential bullish reversal (bullish divergence).

Sell Entry

- XCCI crosses below the -100 level: This suggests a strong bearish trend and a potential sell opportunity.

- XCCI moves from positive to negative territory: When the XCCI shifts from above 0 to below 0, it signals increasing bearish momentum.

- XCCI is below the zero line and trending downwards: A falling XCCI in the negative range indicates strengthening downtrend conditions.

- Resistance level confirmation: If the price fails to break through resistance while the XCCI shows downward movement, it could be a sign to sell.

- Divergence: If the price makes a new high while the XCCI shows a lower high, it suggests a bearish reversal (bearish divergence).

Conclusion

The Exponential Commodity Channel Index (XCCI) for MetaTrader 4 is an invaluable tool for traders who need quicker, more reliable signals in their trading strategies. By enhancing the traditional CCI with exponential smoothing, the XCCI provides faster responses to price movements, helping traders stay ahead of the market. Whether you are new to trading or have years of experience, integrating the XCCI into your trading strategy can improve decision-making, increase market timing, and ultimately lead to more successful trades. Don’t miss out on the opportunity to use this powerful tool to enhance your trading skills and results.

Recommended MT4/MT5 Broker

XM Broker

- Free $50 To Start Trading Instantly! (Withdraw-able Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

- Exclusive 50% Cash Rebates for all Trades!

Already an XM client but missing out on cashback? Open New Real Account and Enter this Partner Code: 𝟕𝐖𝟑𝐉𝐐

(Free MT4 Indicators Download)

US Dollar rises after bloddy Thursday, markets asses NFP and Powell’s words

April 5, 2025 by admin

Filed under Forex Tips

- DXY climbs near the 103 zone on Friday as strong job numbers offset ongoing tariff uncertainty.

- Fed Chair Powell warns tariffs could lift inflation and dampen growth while hinting at no rush for policy moves.

- Resistance is seen at 103.73 and above; support is near 102.61 as technicals remain largely bearish.

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, rises on Friday and is trading near the 103 area following a stronger-than-anticipated Nonfarm Payrolls report. The Greenback’s momentum is also shaped by Federal Reserve (Fed) Chairman Jerome Powell’s remarks, where he flagged greater-than-expected inflation risks from tariffs while emphasizing the Fed’s wait-and-see approach. Technically, DXY remains in a bearish structure despite the rebound.

Daily digest market movers: US Dollar recovers as Powell strikes balance

- US Nonfarm Payrolls surged to 228,000 in March, well above the 135,000 forecast and even beating the highest projections.

- Fed Chair Powell acknowledged that tariffs could have a stronger-than-anticipated inflationary and economic impact, though policy changes remain on hold for now.

- He reiterated that inflation is closer to target but still slightly elevated, and the Fed is monitoring uncertainty from federal policies, especially trade.

- Powell stated the Fed’s job is to avoid temporary price hikes turning into persistent inflation, though long-term expectations remain anchored.

- China’s retaliation came swiftly, with a 34% tariff on all US imports from April 10, compounding fears of an extended trade conflict.

- Powell also highlighted a slowdown in progress toward the 2% inflation target while noting that the job market remains balanced with low unemployment.

- Surveys indicate a deteriorating sentiment and higher uncertainty amid escalating geopolitical and economic tensions.

Technical analysis

The US Dollar Index (DXY) climbs modestly in Friday’s session, but bearish undertones persist as it hovers around the 103 area. The Moving Average Convergence Divergence (MACD) continues to flash a sell signal, and while the Relative Strength Index (RSI) reads 35.58—within neutral bounds—it reflects a fragile bullish momentum. The 20-day, 100-day, and 200-day Simple Moving Averages (SMA), alongside the 10-day Exponential Moving Average (EMA), all point to a bearish trend. The Ultimate Oscillator and Stochastic %K are also neutral, confirming indecision. On the upside, resistance levels are seen at 103.50, 103.73, and 103.81. Meanwhile, support rests at 102.61, with further pressure likely if that level gives way.

Nonfarm Payrolls FAQs

Nonfarm Payrolls (NFP) are part of the US Bureau of Labor Statistics monthly jobs report. The Nonfarm Payrolls component specifically measures the change in the number of people employed in the US during the previous month, excluding the farming industry.

The Nonfarm Payrolls figure can influence the decisions of the Federal Reserve by providing a measure of how successfully the Fed is meeting its mandate of fostering full employment and 2% inflation.

A relatively high NFP figure means more people are in employment, earning more money and therefore probably spending more. A relatively low Nonfarm Payrolls’ result, on the either hand, could mean people are struggling to find work.

The Fed will typically raise interest rates to combat high inflation triggered by low unemployment, and lower them to stimulate a stagnant labor market.

Nonfarm Payrolls generally have a positive correlation with the US Dollar. This means when payrolls’ figures come out higher-than-expected the USD tends to rally and vice versa when they are lower.

NFPs influence the US Dollar by virtue of their impact on inflation, monetary policy expectations and interest rates. A higher NFP usually means the Federal Reserve will be more tight in its monetary policy, supporting the USD.

Nonfarm Payrolls are generally negatively-correlated with the price of Gold. This means a higher-than-expected payrolls’ figure will have a depressing effect on the Gold price and vice versa.

Higher NFP generally has a positive effect on the value of the USD, and like most major commodities Gold is priced in US Dollars. If the USD gains in value, therefore, it requires less Dollars to buy an ounce of Gold.

Also, higher interest rates (typically helped higher NFPs) also lessen the attractiveness of Gold as an investment compared to staying in cash, where the money will at least earn interest.

Nonfarm Payrolls is only one component within a bigger jobs report and it can be overshadowed by the other components.

At times, when NFP come out higher-than-forecast, but the Average Weekly Earnings is lower than expected, the market has ignored the potentially inflationary effect of the headline result and interpreted the fall in earnings as deflationary.

The Participation Rate and the Average Weekly Hours components can also influence the market reaction, but only in seldom events like the “Great Resignation” or the Global Financial Crisis.

Heavy losses drag pair near 88.60 as bearish momentum accelerates

April 5, 2025 by admin

Filed under Forex Tips

- AUD/JPY plunged near the 88.60 zone on Friday, marking a sharp retreat ahead of the Asian session.

- MACD confirms a sell signal as the pair faces broad bearish pressure despite neutral oscillators.

- Key resistance stands at 91.53 and 92.92, while moving averages point to extended downside risk.

The AUD/JPY pair tumbled aggressively on Friday, retreating toward the 88.60 area after shedding over 4% during the day. The move represents one of the steepest intraday declines in recent sessions, dragging the pair away from the recent highs and into a mid-range zone between 87.41 and 92.64. The plunge comes as broader technicals align in favor of sellers, even as some oscillators remain neutral.

Daily chart

Technical indicators reflect a clearly bearish outlook. The Moving Average Convergence Divergence (MACD) is flashing a strong sell signal, reinforcing downside momentum. Meanwhile, the Relative Strength Index (RSI) sits at 25.56, still neutral but nearing oversold territory. Other momentum measures, such as the Awesome Oscillator (-1.112) and the Ultimate Oscillator (36.03), also remain in neutral zones, suggesting that the momentum may still be building rather than exhausted.

Supportive of the bearish structure, all key moving averages are aligned lower. The 20-day Simple Moving Average (SMA) at 93.72, the 100-day SMA at 96.42, and the 200-day SMA at 98.35 are all reinforcing sustained downside pressure. The 10-day Exponential Moving Average (EMA) and 10-day SMA, both hovering around 92.92–93.61, now act as firm resistance following the latest breakdown.